Smart conveying technology: The global market size exceeds 3 billion, and domestic newcomers are gaining momentum

2025.07.23

2025.07.23

Industry News

Industry News

What is smart conveying technology?

Smart conveying technology (SCT) is a new type of transmission technology in which multiple movers can move independently. Because of its electromagnetic drive principle, it is also called "magnetically driven flexible conveyor line". This market is an emerging field that has attracted much attention. Although its commercialization history is nearly 30 years, it has actually been popular in the past decade. Most manufacturers in the global market have launched related products in the past 5-8 years. Compared with traditional conveying systems, smart conveying technology is regarded as a high-quality solution to change the configuration of production lines. There are two types of smart conveying products on the market: Linear smart conveying technology: a conveying technology based on direct-drive linear motors that allows multiple "movers" (or trolleys, pallets) to travel along circular or linear guides. Regardless of open-loop or closed-loop operation, the control of each mover in the system is independent of each other. The circular system in this type of product is also called a "magnetically driven circular line". Planar smart conveying technology: allows multiple "movers" to move in two horizontal directions. In some products, the movers can also tilt, rotate, or rise and fall slightly. Similarly, each mover is controlled independently of each other. The movers in this type of product "suspend" on a plane in a frictionless manner, also known as "magnetic levitation conveying system".

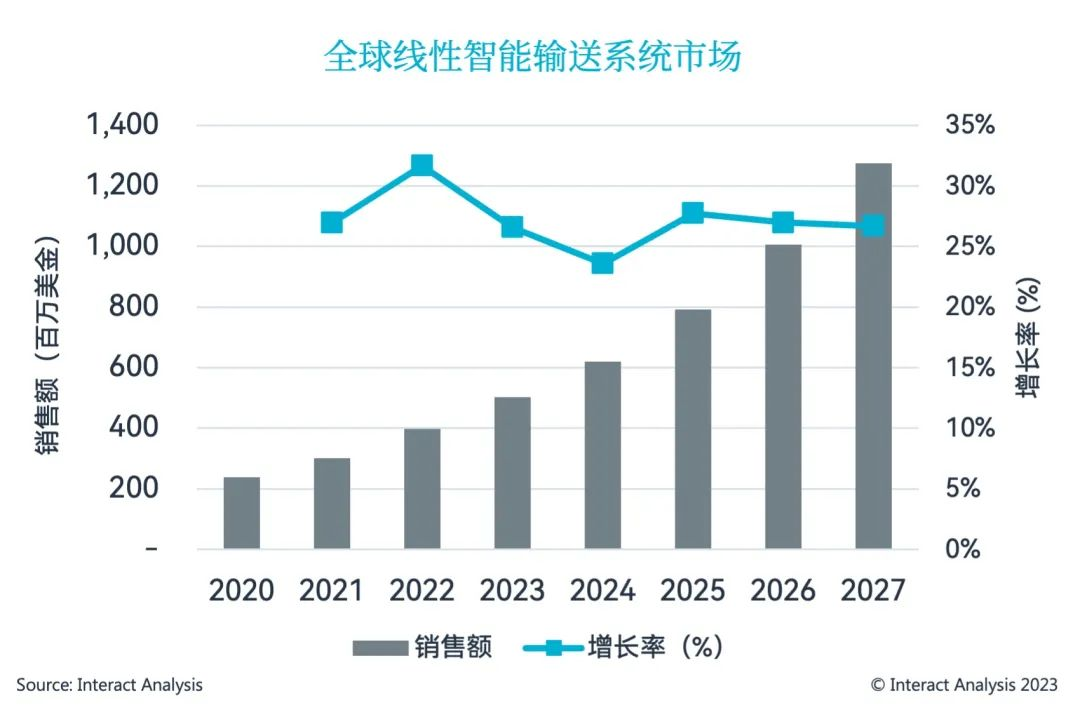

The intelligent conveying technology market has grown rapidly in the past three years. The sales of the linear intelligent conveying technology market in 2022 increased by 32% year-on-year, higher than 27% in 2021. Affected by the global economic macro-environment in 2023-2024, the market growth is expected to slow down, but it will still maintain a high growth rate of more than 20%. From 2022 to 2027, the global linear intelligent conveying technology market is expected to have a compound annual growth rate of 26.3%, which will increase from US$400 million in 2022 to more than US$1.2 billion in 2027.

The pharmaceutical, semiconductor and electronics, and food and beverage industries are currently the top three application markets for intelligent conveying technology in the world, especially in Europe, the United States, Japan and other markets. These industries are the earliest fields to apply this technology. The high degree of automation, the demand for flexible production lines, and the relatively insensitive characteristics of price have enabled these industries to quickly embrace magnetic drive conveying technology.

However, the development of China's lithium battery manufacturing industry has brought new growth points to this once "black technology". Battery manufacturing is the fastest growing application industry during the forecast period and is expected to become the third largest application market for intelligent conveying systems in the world in 2027. With the penetration of this technology in the lithium battery industry and the entry of domestic brands, the growth rate of China's intelligent conveying market is expected to continue to exceed the global average. By 2027, China's sales share in the global market is expected to rise to nearly 40%.

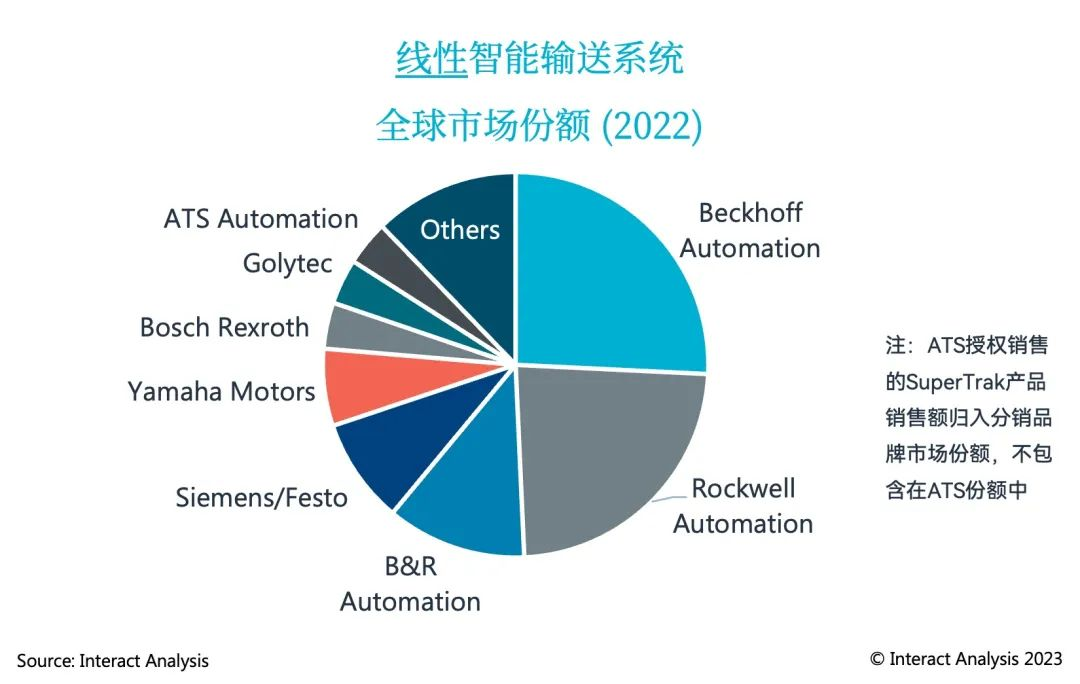

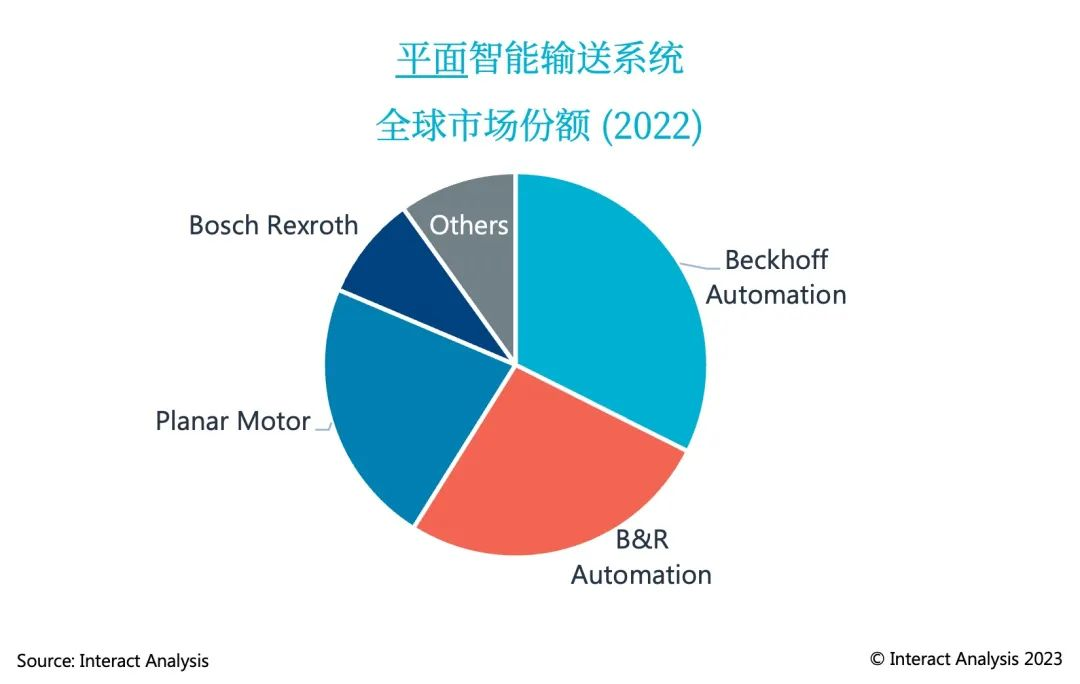

In terms of the two types of products, the global market size is basically all from linear intelligent conveying systems, and the planar intelligent conveying market is still in a very early stage. European and American manufacturers still dominate, and domestic brands are strong.

Globally, there are not many manufacturers that sell intelligent conveying products on a large scale. In the linear intelligent conveying market, 6 European and American manufacturers account for more than 80% of the market share (2022), with Beckhoff, Rockwell and B&R ranking in the top three. Planar magnetic levitation conveying systems are even more limited. Only a few companies have launched products.

However, the current share can only reflect the historical situation. As a fast-growing emerging market, the market structure of intelligent conveying technology is undergoing drastic changes. Manufacturers in the Asia-Pacific region are rising, and domestic brands such as Ruoli and Zongwei are strong and are beginning to appear at international exhibitions. Since 2023, more than a dozen domestic brands have launched new magnetic-driven conveyor lines into the market and successfully developed customer cases in multiple industries, accelerating the domestic market's acceptance of intelligent conveying systems.

English

English  русский

русский Español

Español